The Ukrainian microcredit market has been undergoing a difficult transformation in recent years. On the one hand, there has been an increase in digitalization and regulatory control, and on the other hand, there has been an increase in illegal credit services operating outside the legal framework.

More than 60% of respondents said they completely or somewhat agree with the statement: “The existence of illegal credit services that do not comply with regulatory requirements undermines trust in legal financial companies.” Even isolated cases of violations by illegal operators create a negative perception of the market as a whole, which poses image risks for conscientious players.

Every incident involving fraud or violation of borrower rights undermines confidence in the entire system. This is a problem for many microfinance services, even though most of them comply with the National Bank’s regulatory requirements and operate under license.

Public perception of living standards

Despite attempts by the market to improve customers’ financial literacy, 86% of respondents believe that MFI services do not help overcome poverty or improve living standards. This is a significant increase compared to 2023, when 78% of respondents shared this view.

The MFI market essentially remains between two poles: the need to quickly obtain money on credit and negative stereotypes formed by unscrupulous players.

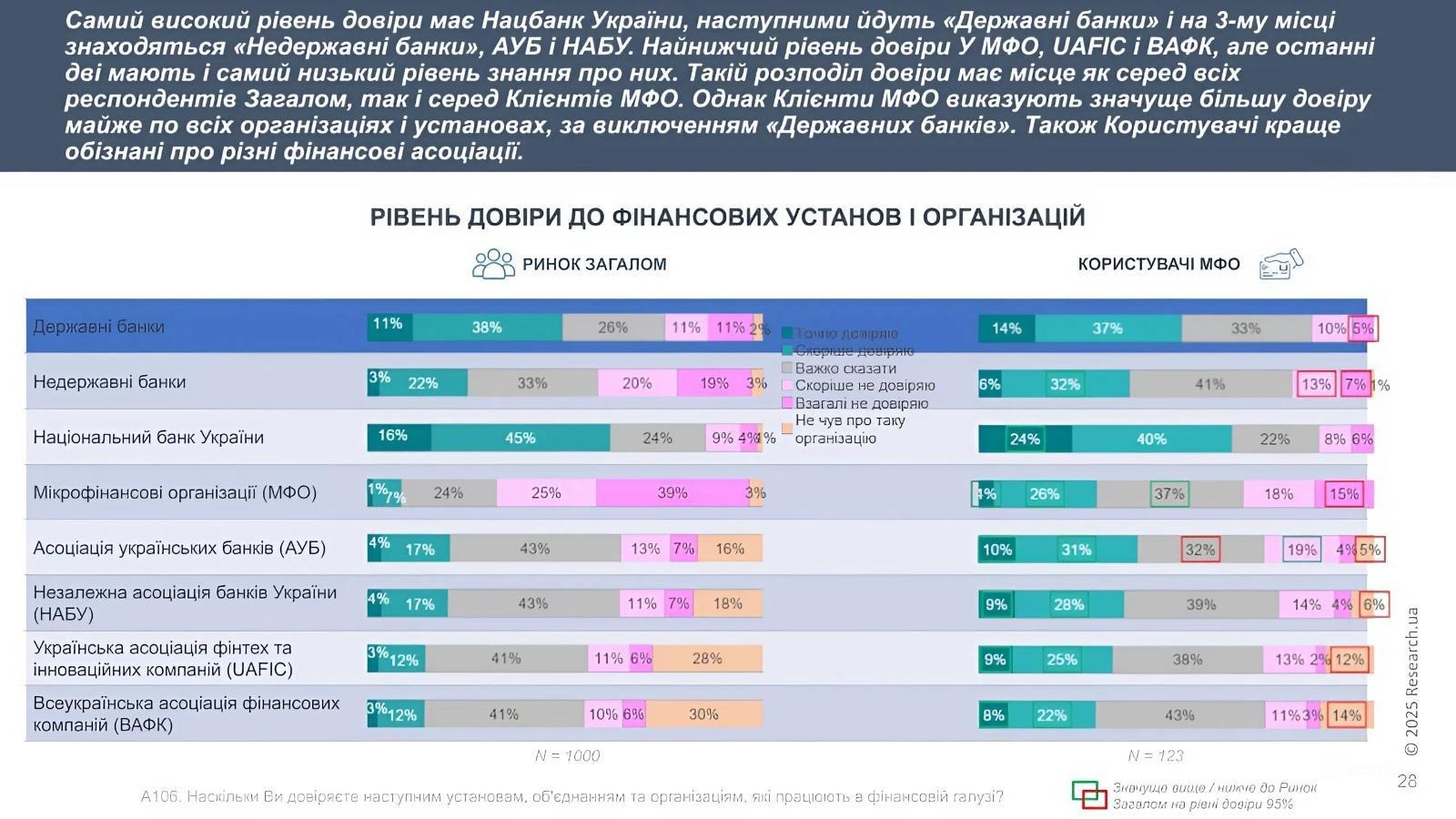

User trust: stability despite everything

Despite public skepticism, MFI users demonstrate a consistently high level of satisfaction: 73% of customers said they were “completely” or “mostly satisfied” with the service they receive, and 69% are willing to recommend the company from which they themselves are most likely to take out online loans. These figures have not changed over the past year and a half, indicating a stable level of trust in specific, legal operators.

The MFI market has proven its necessity and viability, but its further development depends on supervision and the elimination of illegal participants, as well as the consistent formation of a financial culture.

Leave a Reply